Nasdaq Rises: Hope for the "Magnificent Seven" Inspires Investors

Friday's trading session on the Nasdaq closed on a positive note, fueled by gains in mega-cap stocks as investors eagerly awaited upcoming earnings reports from some of Wall Street's largest players. This anticipation created a notable surge of interest across the market.

Tesla Back in the Spotlight

Tesla shares became a symbol of renewed optimism on Wall Street. Brian Jacobsen, Chief Economist at Annex Wealth Management, noted that Tesla's performance strengthened investors' belief that the rally in tech giants — known as the "Magnificent Seven" — is far from over. This elite group includes the stocks of major companies that are sensitive to interest rate changes and actively involved in AI advancements.

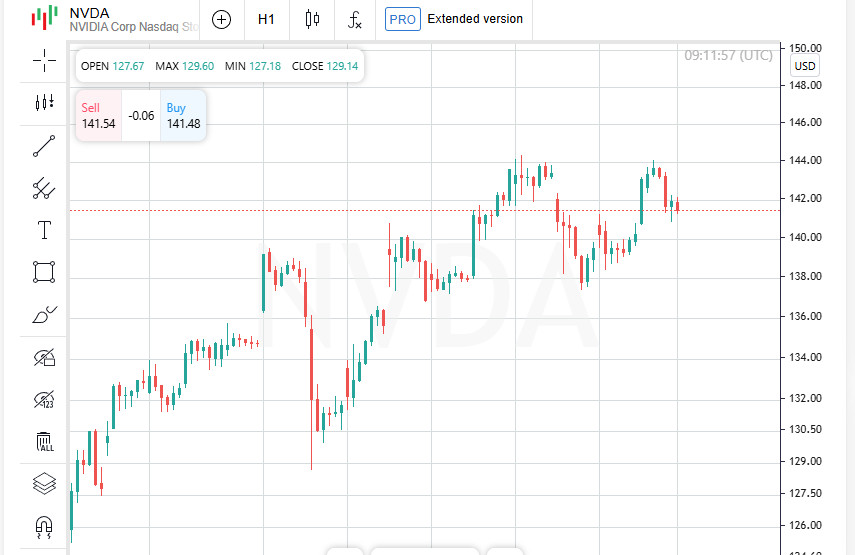

Nvidia Takes the Lead Over Apple

Amid this tech rally, Nvidia (NVDA.O), the largest chipmaker, briefly surpassed Apple (AAPL.O), making it the most valuable company by market capitalization. This achievement highlights the high interest in AI-developing companies, further supporting the entire tech sector.

A Test of Resilience: Bond Yields and Employment Data

Investors are also closely monitoring U.S. 10-year Treasury yields, which rose again. On Friday, they approached a three-month high of 4.26%. This level of yield generally pressures the stock market, raising questions about the future of Federal Reserve interest rates. All eyes are now on next week's U.S. employment data, which may provide clues about the Fed's upcoming rate decisions.

Dow Falls: Banks and McDonald's Struggle

The Dow Jones Industrial Average (.DJI) dropped by 259.96 points, or 0.61%, to settle at 42,114.40. Meanwhile, the S&P 500 (.SPX) slipped by 1.74 points, or 0.03%, to 5,808.12, while the Nasdaq Composite (.IXIC) gained 103.12 points, or 0.56%, reaching 18,518.61.

The Dow Jones dropped primarily due to weak bank stock performance. For example, shares of Goldman Sachs (GS.N) fell by 2.27%. McDonald's (MCD.N) also lost 2.97% amid a negative reaction to news of an E. coli outbreak allegedly linked to its burgers.

Next week promises to be eventful, as the earnings results of major companies and economic data could set a new tone for Wall Street.

Stock Market in Tension: High Valuation of S&P 500 Under Pressure of Expectations

The S&P 500 (.SPX) has shown impressive annual growth of about 22%, but recent days have seen a pullback from record levels. Despite this, stocks remain highly valued, making them vulnerable in the event of unexpected disappointments in the near future.

Record Price-to-Earnings Ratio: Risk or Growth Signal?

According to LSEG Datastream, the S&P 500 P/E ratio, calculated based on expected earnings over the next 12 months, reached 21.8. This value is approaching a three-year high, highlighting investors' high expectations. High multiples, as known, can provoke a deeper correction in case of negative news, and in the coming days, investors, as noted by Chase Investment Counsel Corp. President Peter Tuz, will be "on pins and needles."

Key Market Players on the Verge of Earnings

Five of the largest tech giants from the "Magnificent Seven" group — the very companies that have consistently influenced the stock market in recent years — are preparing to release their quarterly reports. Next week, investors will closely monitor the results of leaders such as Alphabet (GOOGL.O), Microsoft (MSFT.O), Meta Platforms (banned in Russia), Apple (AAPL.O), and Amazon (AMZN.O). The outcome of their reports could set the tone for the market in the near future.

High Stakes for Tech Giants

The combined market value of these giants constitutes 23% of the total S&P 500. This means that their financial results could significantly impact the overall market, as any fluctuation in these corporations' stocks will inevitably affect the main indices.

Investors on Edge: The "Magnificent Seven" Under Close Scrutiny

Shares of the so-called "Magnificent Seven" companies are currently trading at a forward P/E ratio of 35. This is significantly above the average for other S&P 500 companies, as these tech giants have consistently outperformed in profit growth. However, experts predict that this gap will gradually narrow in the coming quarters.

High Multiples Under Pressure: Expectations in the Balance

Bryant VanCronkhite, Senior Portfolio Manager at Allspring Global Investments, noted that high valuations are only justified as long as these companies maintain stable growth. "If the justification for these high valuations weakens, there could be significant downside," he emphasized, adding that stock price fluctuations will directly depend on the consistency of growth metrics.

AI Investments: Path to Future Gains or Risky Bet?

Investors are paying close attention to these tech giants' spending on artificial intelligence. Companies with massive AI platforms, such as Microsoft, Amazon, Alphabet, and Meta, plan to increase capital spending by 40% this year. Meanwhile, other companies in the S&P 500 are expected to cut capital spending by 1% in 2024, according to BofA Global Research. This underscores the strategic importance of AI initiatives for tech leaders, but also raises questions about the potential return on these investments.

Tesla Kicks Off Earnings Season: Musk Forecasts Sales Growth

Tesla (TSLA.O) became the first of the "Magnificent Seven" to release its latest quarterly results. The company saw a boost in its stock price after CEO Elon Musk announced plans to increase car sales by 20-30% next year. This positive outlook heightened interest in the upcoming earnings reports and further fueled enthusiasm for Tesla shares, which remain influenced by the company's ambitious goals.

In the coming weeks, investors will assess whether the new investments in artificial intelligence and technology scaling justify the high expectations placed on the "Magnificent Seven," or if the market will need to adjust its hopes.

A Packed Earnings Week: Corporate Results and Key Economic Data

The upcoming week promises to be one of the busiest for the third-quarter earnings season, with over 150 companies from the S&P 500 expected to report their financial results. This is a crucial moment for the market, as many investors are counting on solid numbers that could drive further growth.

Employment Report: New Jobs Under Analysts' Spotlight

The U.S. employment report, expected on November 1, comes amid debates over whether a robust economy could prevent the Federal Reserve from cutting interest rates. Economists estimate that the U.S. economy added around 140,000 jobs in October. However, recent severe storms could complicate the data. Special attention will be on wage data, as it may provide insight into future inflation dynamics, explained Nanette Abuhoff Jacobson, Global Investment Strategist at Hartford Funds.

Treasury Yield Rises: Shifting Expectations

This week, U.S. Treasury yields reached three-month highs, indicating rising expectations of a less dovish Federal Reserve policy. Moreover, there is an increasing likelihood of higher spending under a new president. Political betting markets have recently raised the probability of a Trump victory, as the Republican candidate is associated with protectionist policies, including tariffs, that could lead to higher inflation.

Mounting Tension: Elections and the Fed's Decision

Next week marks the beginning of a series of significant events that could impact the market. From Election Day on November 5 to the Federal Reserve's announcement on November 7, investors may find themselves in a state of anxious anticipation. In such an environment, every economic report and corporate result will be critical in shaping future market sentiment.

Volatility Returns: VIX Indicator Signals Increased Risk

The Cboe Volatility Index (.VIX), known as an indicator of demand for protection against market swings, is again showing signs of strain. After dipping below the 15 mark at the end of last month, the VIX is now hovering around 19, reflecting growing unease among market participants ahead of the upcoming election.

Analysts Warn: Prepare for Swings

UBS Global Wealth Management analysts, in a Thursday note, highlighted that investors should brace for increased volatility ahead of the November 5 presidential election. As Election Day approaches, market confidence will likely remain under pressure, and any news event could trigger sharp price swings.

Vulnerable Sentiment: Market on the Verge of Change

Experts believe that the high volatility is tied to overall uncertainty and political risks that typically accompany election periods in the U.S. Investors seeking to protect their assets are increasing demand for protective options, which is reflected in the VIX's rise.