The euro collapsed at the beginning of today's European trading session, while the dollar strengthened. Investors returned to the market after the weekend in the US. Recall that the United States celebrated Independence Day on Monday, and banks and stock exchanges were closed.

Thus, the EUR/USD pair fell by 1.24% in the first two hours of the European trading session, falling by 128 points to 1.0307, and by then, the pair was declining to an intraday and a new local low (since January 2003) at 1.0280.

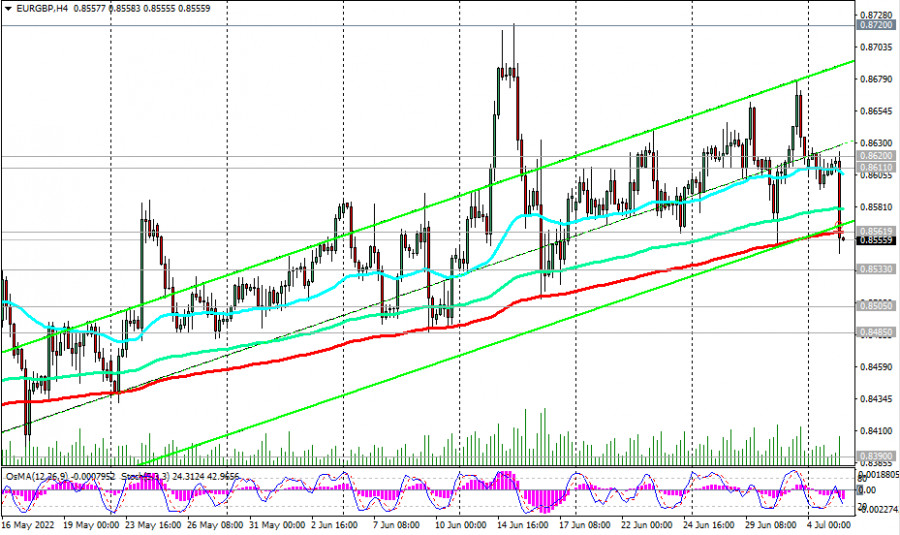

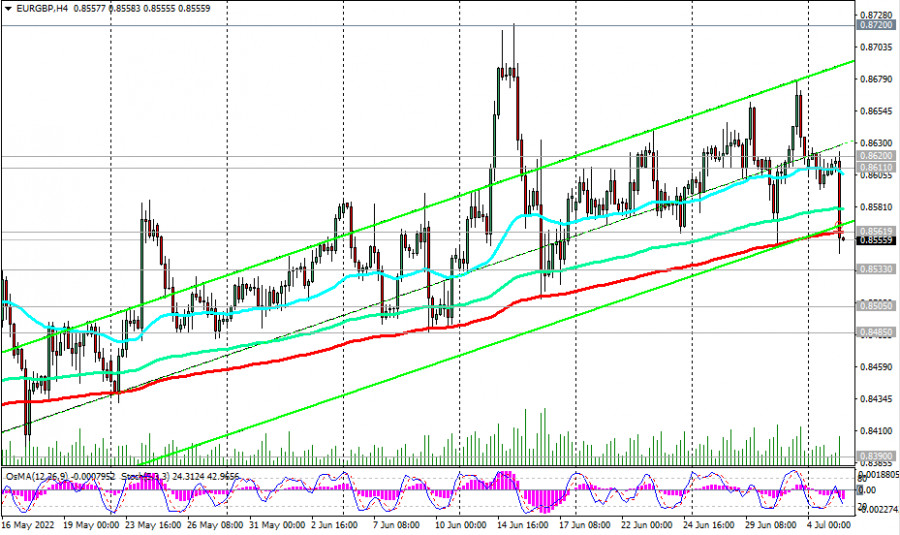

The euro also declined sharply in the main cross-pairs. Thus, the EUR/GBP pair fell at the beginning of today's European session to an intraday and 3-week low near the 0.8546 mark, breaking through an important support level of 0.8562. Well, since the EUR/GBP upward trend is still maintained, it is likely that this support level of 0.8562 should be considered as a suitable zone for opening or building up long positions.

The euro received a negative momentum on Monday, after the German Federal Statistical Office presented fresh data on the dynamics of the trade balance: German exports decreased by 0.5% in May after an increase of 4.4% a month earlier, and the German trade balance in May was in deficit, amounting to -1 billion euros (the forecast was 2.4 billion euros against 3 billion euro in April). The German economy, as you know, is the locomotive of the entire eurozone economy. Therefore, the deterioration of the macroeconomic indicators of this country has a negative impact on the euro quotes. In addition, following European Central Bank Vice President Luis de Guindos' speech from yesterday, the European economy is very close to recession. According to him, high energy prices, deteriorating terms of trade and the negative impact of high inflation on disposable income create increased risks for the ECB's medium-term forecast for the eurozone economy.

At the same time, the mood of eurozone investors has deteriorated sharply. This is evidenced by the Sentix investor confidence index published on Monday, which fell to -26.4 in July against the forecast of -19.9 and against the value of -15.8 in May.

The euro ignored the positive macro statistics published this morning, according to which the S&P manufacturing composite PMI for the eurozone in June was 52, and the similar PMI in the services sector in June was 53.

Meanwhile, the market expects the Bank of England to continue to tighten monetary policy after it has already made five interest rate hikes after cutting them to a historic low of 0.10% in March 2020. Now the interest rate of the BoE is at the level of 1.25%, and inflationary risks in the UK remain extremely high.

In their speeches on Wednesday, BoE representatives Huw Pill and John Cunliffe are also likely to speak in favor of further tightening of monetary conditions in the country. Today, another representative of its management and a member of the Monetary Policy Committee, Silvana Tenreyro, can touch upon the topic of the monetary policy of the BoE. Her speech may also increase the volatility in the pound quotes and, accordingly, the EUR/GBP pair.

Of the main features of the EUR/GBP pair, the following can be noted. The surge in trading volatility in the pair, in addition to the release of news of a political nature, during the release of important macroeconomic indicators for the eurozone, Germany, Great Britain and the US. The following macroeconomic factors and indicators give the greatest volatility to the EUR/GBP pair:

- Decisions of the Bank of England and the ECB regarding monetary policy in the UK or the euro area,

- speeches by the heads of the BoE and the ECB (currently Andrew Bailey and Christine Lagarde, respectively),

- the minutes from the latest meetings of the BoE and the ECB on monetary policy issues,

- data from the labor market of Great Britain, eurozone, Germany,

- GDP data for the UK, eurozone, Germany,

- data on inflation indicators of Great Britain, eurozone, Germany.

Strong macroeconomic indicators for the UK or the eurozone lead to a strengthening of the pound or the euro, respectively, as they contribute ot the growth of "tough sentiments" of the central banks of the UK or the eurozone regarding an interest hike. And this is a positive factor for the national currency, which leads to an increase in its value.

Important political events in the UK, the eurozone and the world also affect currency quotes, and above all, the pound and the euro. Asset sales on European stock markets usually lead to an increase in the value of the euro, including in the EUR/GBP pair. And vice versa. The growth of the stock market in the eurozone, as a rule, is accompanied by a decrease in the value of the euro.

The same can be said about the pound and the British stock market, which have an inverse correlation (with respect to the national currency and stock indices), although much less noticeable compared to the inverse correlation of the dollar and US stock indices.