What are crypto tokens?

To understand the digital asset market and, even more importantly, to make money in it, it is essential to grasp at least the basic concepts. Cryptocurrency tokens are digital assets that represent value or rights within blockchain networks. They can be used for financial transactions, accessing services, or voting in decentralized systems.

Understanding the market is crucial for anyone looking to earn in this space. Today, we will explain what cryptocurrency tokens are, how they differ from coins, and the risks associated with investing in them.

What is cryptocurrency?

Cryptocurrency is a decentralized payment system. Cryptocurrency allows people to transfer money around the world, and these transactions are recorded in a public ledger. Since it operates independently, transactions take place directly between users without intermediaries.

Cryptocurrency only exists in digital form. Unlike traditional money, it has no physical representation. These assets are stored in digital wallets. They are created by individuals or entire companies and are not controlled by governments or banks. Users benefit from fast and low-fee transfers, making it a cost-effective alternative to traditional banking. In addition, the decentralized nature of cryptocurrency makes it a reliable and secure payment system.

Cryptocurrency assets are divided into two categories: coins and tokens. Each has different characteristics and serves various purposes, but both can be used for payments.

Coins

A coin is a digital cryptocurrency that has its own blockchain. It is primarily used for transactions between users and paying for services. All operations within the blockchain are secure, protected by encryption, and transaction details are only accessible to those involved.

Bitcoin and Ethereum are prime examples of coins. Every transaction made with these coins is recorded on their respective blockchains. For instance, if you make a transaction using Ethereum coins, the transaction will be recorded on the Ethereum blockchain. Similarly, Bitcoin transactions are recorded on the Bitcoin blockchain.

Coins are designed to facilitate payments for goods and services, and their use is growing in popularity. For example, companies like Amazon, Microsoft, and Tesla accept digital currencies. In El Salvador, Bitcoin has even been recognized as equivalent to the US dollar.

Top coins

The most well-known coins with their own blockchains are Bitcoin and Ethereum. These two digital assets are in high demand, and many crypto projects have been built on their blockchains. Let's take a closer look at each of them.

Bitcoin

Bitcoin emerged in 2009 as a means of conducting virtual transactions. Its exact creator remains unknown, though they used the pseudonym Satoshi Nakamoto. There is speculation that it could be either a group of people or an individual.

Bitcoin operates on its unique blockchain, making it a decentralized asset. This means that it cannot be controlled by any government or bank. Today, Bitcoin is the most recognized cryptocurrency globally and the first-ever documented in history.

Ethereum

Ethereum is another popular blockchain platform, ranking second only to Bitcoin. Its primary function is to support smart contracts and decentralized applications, especially their monetization. Ethereum is also widely used for digital transactions.

Other notable blockchain-based assets include Litecoin, Ripple, EOS, Tezos, and Cardano, each designed for specific purposes and boasting unique features.

What are crypto tokens?

Like coins, tokens are digital assets. However, unlike coins, tokens do not have their own blockchain. Instead, they operate on existing blockchains such as Bitcoin or Ethereum. For this reason, tokens cannot be classified as full-fledged cryptocurrencies, although they have value, just like coins.

The main difference between coins and tokens is that tokens are built on an external blockchain, whereas coins operate on their own. While coin transactions take place directly within their respective blockchains, token transactions are managed via smart contracts. Each blockchain has its own smart contract code that facilitates these transactions. For example, Ethereum uses the ERC-20 standard. In token transactions, the tokens themselves do not physically move; rather, the account balance is updated.

Coins and tokens serve different purposes. Coins act as digital currencies, while tokens are often used within specific ecosystems. Some of the most popular platforms for creating tokens include Ethereum, Binance Smart Chain, and Solana, with Ethereum being the most widely used.

Exchanging tokens is relatively easy if they share the same coding standard. Such transactions can be done through specialized apps and within the same network. However, if tokens use different protocols, they can only be exchanged on cryptocurrency exchanges.

What is tokenization?

Tokenization refers to the process of converting real-world assets into digital assets. In this case, a token acts as a digital certificate, granting ownership rights to a specific asset.

For instance, let's say a construction company wants to tokenize its operations. The business creates tokens, each of which can be exchanged for one hour of the owner's labor. These terms are listed at auction. If the business performs well, the value of its tokens will increase. Conversely, if the work is subpar, demand will decrease, and the value of the token will drop due to lack of interest.

Another example: Imagine a new building valued at $100,000. We decide to tokenize it by dividing its value into 1,000 tokens, each priced at $100. To attract investors, these tokens are auctioned off. Anyone with $100 can invest by purchasing a token on a trading platform. Once the building is completed, the value of the property and the tokens will increase, allowing investors to sell their tokens for a profit.

Nowadays, assets are tokenized on blockchains, which simplifies and speeds up the process. Thanks to smart contracts, many steps are automated. In addition, blockchain technology ensures the security of assets, eliminating the need for intermediaries.

Types of tokens

Now that we know what cryptocurrency tokens are and how they differ from coins, let’s dive into the various types of tokens. Tokens can be categorized based on their functions and characteristics, each serving a unique purpose.

- Utility tokens: These tokens allow users to interact with a company’s platform and access its services. They act as digital tickets that provide access but are not considered an investment. For example, if you purchase tokens from a VPN company, you can use them to pay for a subscription to their services.

- Tokenized securities: These are similar to stocks on a traditional exchange. They attract investors who want to fund a project in the hope that it will grow. If the company prospers, its securities gain in value. Conversely, if the company declines, so does the value of its securities. It is beneficial to invest early when the tokens are cheaper, potentially making significant profits if the project succeeds. For instance, the TAAS Fund pays out 50% of its profits to its STO holders every few months.

- Debt tokens: Issued by companies seeking to raise capital for project development, they work much like bonds. Investors lend money to the company, which promises to pay it back over time with interest. The tokens can later be exchanged for fiat currency.

- Asset-backed tokens: These tokens are tied to a specific good or service, with each token representing a specific value. For instance, a company might issue a token that represents one gram of gold. A prominent example is Tether, which pegs its tokens to the US dollar at a 1:1 ratio.

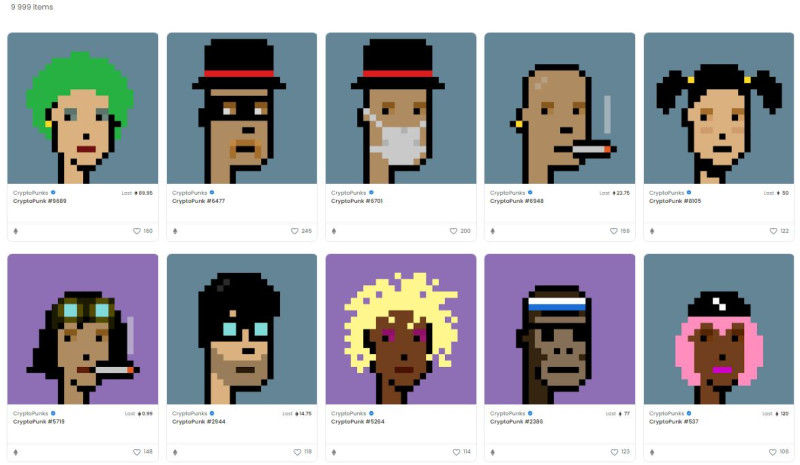

- NFT tokens: Non-fungible tokens (NFTs) are unique and cannot be replaced by other tokens. Each NFT has a certificate of ownership and is often used in virtual art and gaming. NFTs are typically built on Ethereum and use the ERC-721 or ERC-1155 standard.

- Governance tokens: Holders of these tokens can participate in a project's development by voting on key decisions and influencing the direction of the project. In some cases, token holders may also manage funds or make financial decisions for the platform.

- Reward tokens: These tokens are awarded to participants for actions that help promote or improve a project. They can be exchanged for goods, services, or company discounts. Users can also exchange them among themselves.

- Donation tokens: These tokens are designed to support a project without expecting a return. Investors contribute to a cause purely for the benefit of the project.

Where are tokens used?

Now that we understand what tokens are, let’s explore where they are applied. Tokens are widely used in the following areas:

- App industry: Tokens can be used to pay for network services and products within an app’s ecosystem, expanding user possibilities.

- Lending: Tokens allow investors to fund projects with high liquidity, similar to bonds. Investors can earn interest on their token holdings over time and even profit from an increase in the value of the token.

- Stocks: Tokens can serve as investments, generating income through commissions. In some cases, token holders may participate in decision-making, though this depends on the project. For instance, the Digix project, built on the Ethereum blockchain, grants voting power based on the number of tokens held.

Developers use tokens in infrastructure projects, while investors can earn extra income by holding them.

How cryptocurrency value is determined

After creating a project, a company decides on its tokenomics, determining how tokens will be issued and distributed. Tokens can be circulated continuously or periodically. Tokens in circulation are referred to as "emission," and some projects start with zero initial tokens, like Bitcoin. Others increase their emission over time.

Token sales allow users to purchase tokens, often through multiple rounds of investment. Some projects even offer tokens as a reward for early participation in project development.

Each token has a maximum supply that cannot be exceeded. For example, Bitcoin has a cap of 21 million coins. The process of halving, which reduces the supply of tokens, prevents inflation and boosts demand, potentially increasing the token’s value.

Burning tokens or permanently removing tokens from circulation can also drive up the value of the token by creating scarcity.

The value of cryptocurrency is not influenced by banks or other institutions, making it highly volatile and unpredictable. Its price is determined by market demand. For instance, if tokens are scarce but there are many buyers, the price will rise, and vice versa. To gauge the demand for an asset, its market capitalization is a useful indicator.

Tokens are issued in limited quantities, with the option to add more later. Each project decides how many tokens to release. If too many tokens flood the market, creators can burn some to prevent a price drop.

Key risks of investing in cryptocurrency

Investing in cryptocurrency assets differs significantly from traditional investments. Cryptocurrency investments carry more risks. Nevertheless, investor interest is strong, with the crypto world evolving rapidly.

Before investing in any cryptocurrency, it is essential to thoroughly research the project and assess its potential and risks. Let's explore the main risks involved in such investments.

High volatility

The cryptocurrency market is known for its high volatility, which is its defining feature. This means that the price of an asset can fluctuate dramatically in a short period.

Experienced investors recommend carefully studying a project before investing in it. Analyze the historical price behavior of a specific asset and track significant changes. This approach helps evaluate volatility and risks. In addition, experts advise against panic when the price falls, as a sharp decline often precedes a strong recovery.

Volatility is a core characteristic of the cryptocurrency market and presents risks of financial loss. However, it also offers opportunities, as sharp price swings can lead to quick profits.

Beginners are advised to start trading in the spot market, which is considered less risky compared to margin trading. Losses in margin trading can be much higher, especially when using high leverage.

Improper storage

Before investing, it is crucial to understand how to store assets safely. Storing cryptocurrency on exchanges is considered less secure and comes with certain risks, as the assets are not fully owned by the investor. The safest way to store assets is in either a cold or hot wallet, with cold wallets being the most secure option.

If you plan to trade rather than hold assets for the long term, you will need to keep your coins on an exchange. Otherwise, trading is not possible.

Transaction errors

If a user makes a mistake when transferring funds, it is impossible to reverse the transaction. The transferred coins will simply be lost. This is because cryptocurrency transactions do not involve intermediaries who could oversee or reverse the process.

Token's impact on crypto market development

Tokens are no longer just used for transferring currency; they play an active role in advancing innovative technologies and driving the overall growth of the cryptocurrency market. They support decentralized applications, facilitate the rise of DeFi (Decentralized Finance), and contribute to the NFT space.

Tokens provide a wide range of opportunities, making them highly versatile. For example, DeFi tokens help create liquidity on exchanges, and governance tokens grant voting rights in decision-making processes.

How to buy tokens

Tokens can be purchased on cryptocurrency exchanges, through specialized marketplaces, or via applications. Purchased assets can be stored either on exchanges or in wallets.

To start trading or buy assets for long-term holding, you must register on an exchange and fund your account. After that, you should identify the desired assets, carefully assess the risks and benefits, and proceed with your purchase.

Conclusion

Cryptocurrency tokens are a broad term that includes all tokens used on cryptocurrency exchanges. They can function as money, tokens, shares, or serve any other purpose. Moreover, the term is expected to continue to expand and take on new meanings.

Tokens are currently just as popular and important to the cryptocurrency ecosystem as coins. When developing a project, companies often create their own tokens as an incentive for users to invest and participate in the ecosystem. By purchasing a token, a user becomes part of the project and can use the tokens within certain applications.

In this article, we have explored what cryptocurrency tokens are and the risks involved in investing in them. As always, it is important to do your research before investing in any project. The cryptocurrency market is highly unpredictable, so it is wise not to invest money that you cannot afford to lose.

Back to articles

Back to articles