Despite the widespread popularity of digital currencies, their universal adoption and legalization remain elusive. In many countries, traditional money, also known as fiat currency, continues to be the only legal tender.

Let’s delve deeper into the key characteristics of fiat and digital currencies, their similarities and differences. Each type of currency serves its functions, often leading users to exchange traditional currencies for cryptocurrencies and vice versa. Let’s explore where and how this can be done.

Learn more about the purpose of digital currencies, how to earn from them through unconventional methods such as earning coins by exercising, learning, or playing by reading the article "What is Crypto?"

What is fiat currency?

Fiat or traditional currency is money that is recognized as legal tender, typically with its value set by law. In other words, these are the national currencies of various countries, issued and circulated under the regulation of their government authorities.

Each country has a specific authority, usually the central bank, responsible for issuing this money. The issuance and total amount of money in circulation are strictly regulated by national governments and financial institutions.

Currently, the value of fiat currencies is not backed by gold reserves as in the past. Instead, the price of traditional currencies is determined by trust in the issuer and confidence in their ability to maintain economic stability within the country.

The primary purpose of these currencies is to serve as the official payment method in the country of issuance, and sometimes in other countries as well. They can also be used to settle debts and for other purposes.

Fiat money comes in different forms in various countries, mainly as banknotes and coins of different denominations. In addition, traditional currencies include digital money in bank accounts, which can be accessed using bank cards.

National currencies are tools that governments can use to regulate monetary policy, including interest rates and open market operations, to stimulate economic growth or curb inflation.

The issuance and circulation of national currencies require serious consideration by state authorities, as mismanagement can lead to negative consequences such as inflation or even hyperinflation.

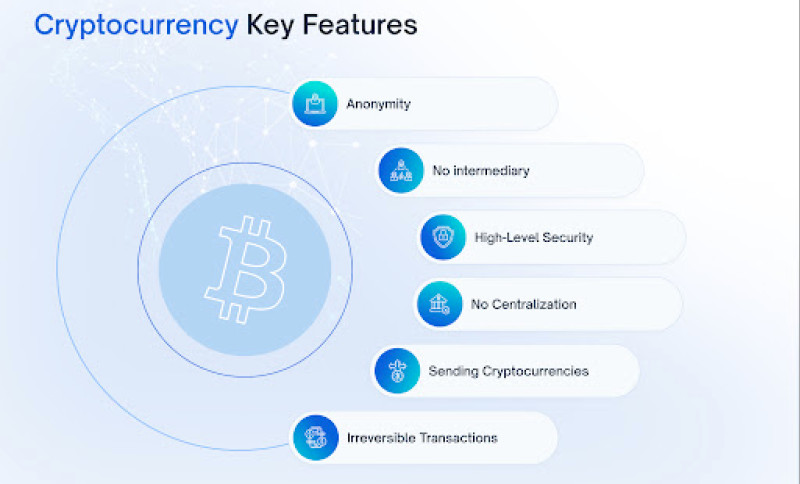

Key features of cryptocurrencies

Before we compare and highlight the key differences between categories like fiat and crypto, let's first understand what cryptocurrencies are and their main characteristics.

Cryptocurrency is digital money that has no physical form. It exists only virtually and possesses several key features that distinguish it from other types of currency:

- Digital currencies are based on blockchain technology, which creates a distributed ledger for processing and storing data. This means that all information is not stored on a single centralized server but on many independent devices.

- All transactions in the blockchain are recorded in blocks that are linked into a continuous chain. Each block, in addition to transaction data, contains a link to the previous one, making it impossible to change or falsify transactions as it would require altering not just one, but all blocks in the chain.

- A special encryption technology called cryptography is used to protect data (hence the term cryptocurrency). This method involves converting any information into a code that can only be decrypted with a special key.

- Another characteristic is decentralization, achieved by storing data across a large number of different devices. Digital currencies are not issued or regulated by any government or any other central authority.

- The value of any cryptocurrency is influenced by supply and demand; it cannot be controlled by any authority or organization. However, it can also fluctuate sharply, a phenomenon known as high volatility.

- Cryptocurrencies have different legal statuses in different countries: in some, they can be used to pay for goods and services, while in others, they can only be used for private transfers or as a means of saving or profiting from investments.

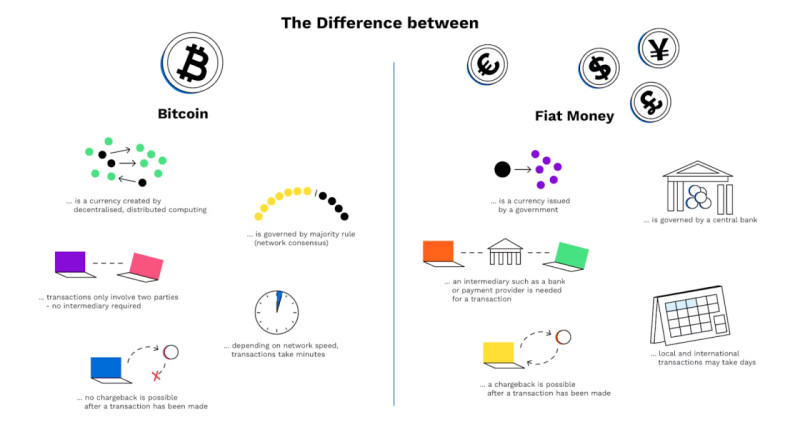

Fiat vs. crypto: key differences

Now that we have clarified what fiat money and cryptocurrencies are, along with their key characteristics, it is time to compare them. While they share some similarities, they also have significant differences.

One of the main similarities between fiat and crypto is that neither has intrinsic value backed by precious metals or other resources. Their value is based on trust: for fiat, it is trust in governments, and for crypto, trust in the development team behind it.

Furthermore, both fiat and cryptocurrencies in digital form can be used for transfers between users, including international ones. However, fiat money transfers can be expensive and slow due to the involvement of numerous intermediaries.

In contrast, crypto transactions are fast and do not require intermediaries. Cryptocurrencies operate using blockchain technology, which leverages smart contracts that execute automatically when specific conditions are met.

The most significant difference between crypto and fiat is that cryptocurrencies are not yet recognized as legal tender in most countries. As a result, digital currencies are primarily used for trading or investment purposes rather than for everyday transactions.

Another difference is that cryptocurrencies have no physical form; they cannot be touched or held. Traditional money comes in the form of banknotes and coins, which may make it more trustworthy in the eyes of some people compared to digital currencies.

A crucial distinction is that the supply of fiat is unlimited, meaning governments can print as much money as they need. In contrast, the supply of most cryptocurrencies is fixed and predetermined at launch.

Let's summarize the key differences between digital currencies and traditional money in the table below:

| Parameter | Cryptocurrencies | Fiat currencies |

| Physical form | No | Yes |

| Transfers | Available | Available |

| Presence of intermediaries | No | Yes |

| Government regulation | No | Yes |

| Supply | Limited | Unlimited |

| Storage | Special crypto wallets | Wallets or bank accounts |

Where to exchange fiat for crypto

If you need cryptocurrency, you can obtain it by exchanging fiat money for digital currency. This fiat-to-crypto exchange essentially means buying cryptocurrency with any other currency, and it is relatively simple. Several platforms offer this service, and we will discuss them briefly.

Some of the most popular platforms for buying digital currencies with fiat include:

- Cryptocurrency exchanges

- Crypto exchange services

- P2P platforms

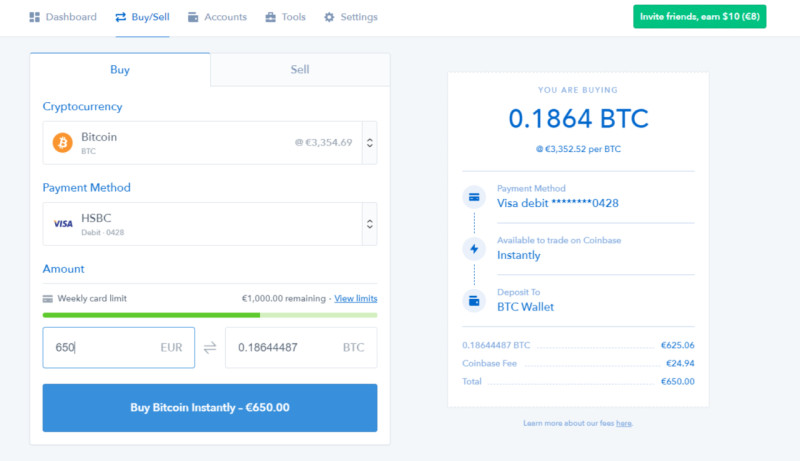

Cryptocurrency exchanges allow not only currency exchanges but also other operations such as trading to generate profit. While the range of available currencies may differ slightly across exchanges, they all offer high liquidity and trading volumes.

Popular crypto exchanges offer user-friendly interfaces and additional features like mobile apps, customer support, market analysis tools, trading options, and enhanced security measures. Typically, exchanges require not just registration but also verification (i.e., identity confirmation), which may deter some users who either do not want to deal with extra procedures or prefer to remain anonymous.

For those users, crypto exchange services offer an alternative. These are specialized platforms designed solely for exchanging one currency for another. Unlike exchanges, users do not participate in trading; the exchange service sets the buying and selling rates. This option can be accessed online through dedicated websites or offline via offices or crypto ATMs.

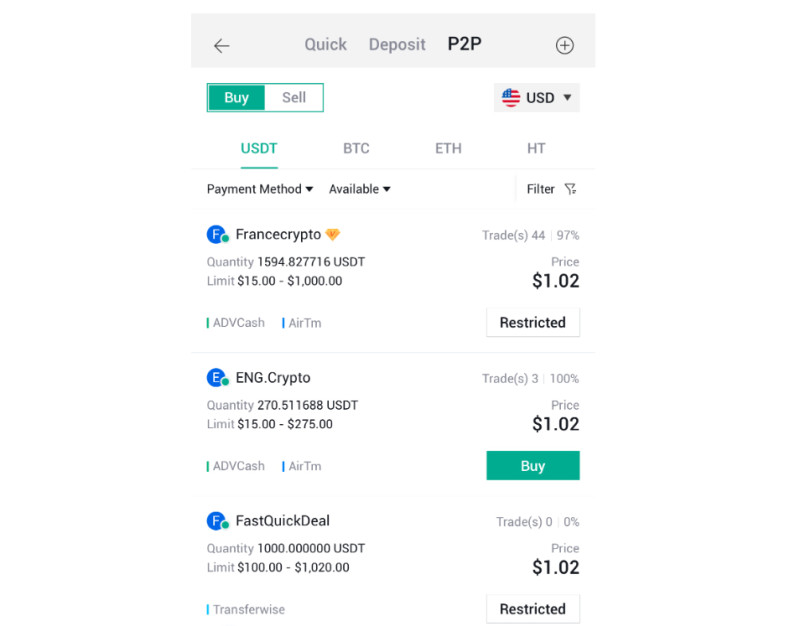

Another option for exchanging digital currencies is P2P platforms. The unique feature of these platforms is that transactions occur directly between users. One user seeks to sell crypto for fiat, while the other seeks to buy it.

On these platforms, users post their offers and connect with each other to complete the transaction. Since the seller sets the price, it can sometimes be more advantageous to buy crypto on P2P platforms compared to exchanges or exchange services, where rates are fixed.

How to exchange fiat for crypto

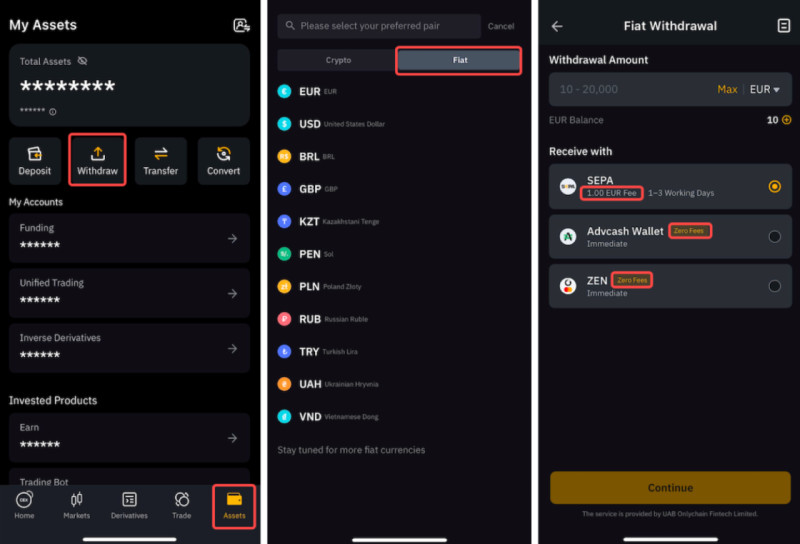

Now that we have covered the platforms where fiat-to-crypto exchanges can take place, let’s look at how exactly this process works. Cryptocurrency exchanges are one of the most reliable ways to exchange traditional money for digital currencies because they offer a higher level of security and data protection.

To perform any actions on an exchange, you need to create an account, which involves registration and verification. Verification typically requires submitting a document that confirms your identity (such as a passport or an ID card). Once the account is created, you will need to fund it.

Exchanges offer a variety of deposit options such as debit or credit cards, bank transfers, and other methods. Generally, there are no fees for depositing funds into your account. However, a commission is charged when you make a transaction, i.e., when you buy crypto with fiat currency, as well as when you withdraw money from your account.

The time it takes to complete a fiat-to-crypto exchange can range from a few minutes to several hours, depending on the exchange’s load, the specific platform, and the currencies involved. Exchange rates are set by the platform and can vary between different exchanges.

If a user is not satisfied with the current rate of a particular cryptocurrency, they can set a desired rate. When the currency reaches that level, the user will be notified and can proceed with the exchange.

P2P platforms operate like a marketplace, where users can post ads to buy or sell crypto and set their own exchange rates and conditions. When a user finds a listing that matches their preferences, they can respond to it, and the transaction can proceed. The platform acts as a guarantor to ensure both parties fulfill their obligations.

Crypto exchange services

Let’s delve deeper into crypto exchange services since fiat-to-crypto exchange is their primary function. Unlike exchanges, they do not trade digital currencies but only exchange them for traditional money or other cryptocurrencies.

There are two types of crypto exchange services: online platforms and offline offices, including crypto ATMs. With online services, you simply visit the website, choose the currency pair for exchange, send the fiat money to the designated account, and receive the crypto in your wallet.

For physical exchange services, you can visit an office to exchange cash for digital currency or use specialized devices called crypto ATMs. These work similarly to regular ATMs, allowing users to buy crypto with fiat money or perform the reverse transaction by exchanging crypto back into fiat.

Offline exchange services and crypto ATMs are especially popular in tourist destinations. This makes it easier for travelers to obtain local currency in exchange for crypto without the need for bank cards or other tools.

At offline exchange offices, the entire exchange process is handled by an operator. They provide the address to which digital currencies should be transferred to receive fiat, and they also hand over the cash after the exchange or, conversely, accept cash and transfer crypto to the user’s wallet.

Where do crypto exchange services get their money for exchanges? Each crypto exchange service maintains a reserve of assets to facilitate exchanges for users. There are two main sources of these funds:

- Company-owned funds: Exchange service owners accumulate funds in both fiat and digital currencies and allocate them to the platform’s reserve. These funds can also come from other business ventures.

- Investor contributions: Owners of exchange services acquire assets from investors, using them for the exchange process. A portion of the profits is then returned to these investors.

Since crypto exchange services set their own exchange rates, they can profit from the difference in rates, similar to how banks operate. In addition, they can offer premium services such as VIP service with money delivered to your home after an exchange.

How to exchange crypto for fiat

Since digital currencies are still not recognized as legal tender in many countries, users often need to not only exchange fiat for crypto but also perform the reverse exchange. This is typically done to withdraw profits earned through crypto trading or investing.

For these purposes, the same methods and tools mentioned earlier for converting fiat to digital currencies can be used. One of the most popular platforms for this is a cryptocurrency exchange. It is user-friendly, reliable, and allows you to withdraw funds directly to your bank account.

There is no need to spend time searching for a counterparty or selecting the best exchange rate. However, it is not recommended to keep your money (in any currency) on the exchange, as these platforms are often targeted by hackers due to their popularity, resulting in the theft of user funds. In addition, exchanges charge a fee for withdrawals.

Another method is using crypto exchange services, which function similarly to traditional currency exchange offices. However, when it comes to cryptocurrencies, the process is slightly different since crypto is stored in digital wallets, requiring certain actions for its transfer.

Offline exchange services have operators who assist with all necessary transactions and provide cash in hand. It is important to be cautious when dealing with private or unregulated exchanges, as there is a risk of encountering fraud and losing both your crypto and cash.

A third option is crypto ATMs, which operate like regular ATMs. Users send the desired amount of cryptocurrency to a specified wallet and receive cash in fiat currency. However, be aware that the fees for exchange services and crypto ATMs can be as high as 15%.

Another common method is using P2P platforms, where users exchange currencies directly with each other. This method can be more profitable since you can find better rates, but it may also require additional time to find a suitable counterparty.

The advantage of P2P platforms over crypto exchange services is that transactions can be completed without the need to visit a physical location. Moreover, the platform itself acts as a guarantor for the safety of transactions and resolves disputes between users if necessary.

Fiat vs. crypto: prospects

What does the future hold for today’s monetary systems? Will fiat currencies or innovative digital currencies win in the battle between fiat and crypto? Let’s explore these and other questions regarding the interaction between these two systems.

The first point to note is that blockchain technology, which underpins cryptocurrencies, already has much broader applications beyond finance. This method of data storage and transfer is used in the banking sector, service industries, payment systems, and many other areas.

Therefore, the technology itself may advance beyond alternative currencies. Nonetheless, we cannot ignore the growing popularity of cryptocurrencies worldwide. Thus, the future could unfold in two scenarios: either crypto fully replaces fiat and becomes legal tender, or both will coexist and be used equally.

For the first scenario to come true, significant changes in the global economy, government regulations, and infrastructure are needed. This is the only way that digital currencies can be universally accepted. However, several factors are slowing this process, with the high volatility of cryptocurrencies being one of the main obstacles.

Thus, it is premature to talk about the complete replacement of traditional money by digital currencies. The second scenario seems more realistic, where both financial systems exist in parallel and play different roles in people's lives and economies.

Conclusion

In this article, we have explored the key characteristics of traditional and digital currencies, as well as the main ways to exchange fiat for crypto and vice versa. Since cryptocurrencies are still not recognized as legal tender in most countries, they are primarily used for other purposes.

This is mainly due to their high volatility, i.e. frequent and sharp price fluctuations. However, this characteristic can be used to make profits through trading or investing. To start engaging in transactions involving crypto, you first need to purchase it.

There are several common methods for exchanging fiat money for digital currencies: cryptocurrency exchanges, crypto exchange services, and P2P platforms. Each method has its advantages and disadvantages, allowing users to choose the option that best suits their needs.

Exchanges are considered the most reliable, but they set their own exchange rates, as do exchange services. While exchange services are more familiar and straightforward, they charge higher fees. P2P platforms allow for more favorable rates but may take more time.

The reverse exchange of crypto to fiat can be done on the same platforms. Since digital and traditional currencies serve different functions, they may coexist for many years, performing various roles in economic, social, and financial spheres without directly competing.

Back to articles

Back to articles