Cryptocurrency can be bought and sold in various ways: using fiat money or by exchanging one digital coin for another. Thanks to the wide range of modern crypto trading services, every user can choose the option that suits them best.

For some users, the most critical factor is getting the best price, while for others, the focus is on transaction security. To buy or exchange digital currencies at the most favorable rate, users often need to monitor multiple specialized platforms, such as P2P networks.

This article explores how to buy and sell cryptocurrency directly, without intermediaries like exchanges. To learn more about digital currencies, their origins, and how to generate income from them, check out our article What is cryptocurrency?

How and where to trade crypto

With the growing popularity of digital currencies, there are more opportunities than ever to trade crypto. In the past, assets could only be purchased on centralized exchanges. Recently, various platforms, including decentralized exchanges and P2P (peer-to-peer) platforms, have been invented.

These platforms enable direct transactions between buyers and sellers without an intermediary exchange. While this method has its advantages and disadvantages, it is worth exploring both aspects in more detail.

What are cryptocurrency exchanges?

To buy or sell cryptocurrency on an exchange, users need to create an appropriate order. A transaction is executed when the price reaches the value set by the user.

Exchanges are divided into two main categories: centralized and decentralized. The key differences between them are summarized in the table below:

| Parameter | Centralized exchange | Decentralized exchange |

| Management | Operated by a single company | No external control or central server |

| Access to assets | Controlled by the exchange | Controlled by asset owners |

| Transaction method | Within the exchange | Between users via smart contracts |

| Privacy | None, requires identity verification | Anonymous transactions |

| Security | Higher | Lower |

| Liquidity | High | Depends on user activity |

| Fee size | Set by the exchange | Determined by the blockchain |

| Ease of use | No technical knowledge required | Requires basic technical knowledge |

| Examples | Binance, KuCoin, Huobi и др. | UniSwap, PancakeSwap и др. |

To start trading on an exchange, users must register and complete a verification process known as KYC (Know Your Customer). This involves confirming their identity with a passport or other documents.

Many users find these procedures cumbersome and prefer alternative ways to acquire cryptocurrency.

P2P platforms

One of the most popular alternatives is P2P platforms. These platforms enable users to directly exchange fiat money and cryptocurrencies without intermediaries. Think of these platforms as a bulletin board where one user posts an ad to buy a certain amount of crypto, and another posts an ad to sell it.

P2P trading offers greater flexibility, often with fewer restrictions than traditional exchanges, making it an appealing option for many crypto enthusiasts.

Whether you choose to trade through centralized exchanges, decentralized platforms, or P2P networks, understanding the pros and cons of each method will help you navigate the evolving crypto market more effectively.

Comparison of different trading platforms

Purchasing digital currencies is generally straightforward. The challenge lies in doing so profitably, which can involve using various platforms: exchanges, exchangers, and P2P networks. Cryptocurrency can be credited to a user’s account either directly or through an intermediary. Let’s compare these options.

Cryptocurrency exchanges

Exchanges are platforms with extensive functionality, where buying and selling are just part of their offerings. They also support margin trading (leveraged funds), participation in affiliate programs, and even their own native cryptocurrencies.

In contrast, exchangers and P2P platforms focus solely on exchanging fiat money for cryptocurrency or swapping one digital asset for another. This simplicity results in a more user-friendly interface, making them accessible even for beginners.

On exchanges, users must register and complete a verification process, while exchangers and P2P platforms often do not require this. While this simplifies the user experience, it can negatively impact security, as such platforms may be more vulnerable to fraud.

Exchanges set the trading rates for currencies, whereas P2P platforms allow users to determine the prices for buying and selling digital assets independently. This can make P2P transactions more advantageous for users.

Exchanges typically offer a broader selection of cryptocurrencies compared to exchangers or P2P platforms and boast much higher liquidity. However, exchanges may have fewer options for fiat-to-crypto exchanges. On some exchanges, cryptocurrencies can only be purchased using other digital assets rather than fiat currencies.

Fees

There are also differences in fees. Exchanges charge a commission for each transaction, meaning the more trades a user makes, the higher the total fees. Exchangers and P2P platforms, on the other hand, charge significantly lower fees or sometimes none at all for transactions.

P2P cryptocurrency trading

P2P platforms function like bulletin boards where users post ads to buy or sell specific amounts of cryptocurrency. When a buyer’s and seller’s offers match, a transaction can occur.

These platforms do not set exchange rates; each user defines their own terms. However, the platform guarantees transaction security. If any issues arise, participants can open a dispute, which the platform will mediate.

On P2P platforms, there are two main types of users:

- Makers. These users create their own offers. They can set exchange rates, transaction volumes, and payment methods. However, they must wait for someone to accept their terms.

- Takers. These users choose from existing offers. Transactions are faster and simpler for takers since they select offers that meet their criteria.

Because offers on P2P platforms are created individually, exchange rates can vary greatly from those on exchanges. This often allows users to buy cryptocurrency at better rates on P2P platforms. However, comparing offers across different platforms is always recommended before completing a transaction.

Private exchangers

In addition to large platforms, there are private exchangers that are even simpler to use. With an app or a Telegram bot, users can select what they want to buy or sell. Once the transaction is confirmed, the exchange is completed.

These tools provide a straightforward option for users who prioritize convenience and speed, often without requiring registration or lengthy verification processes. Regardless of the chosen method, comparing rates and ensuring security should always be a priority when trading cryptocurrency.

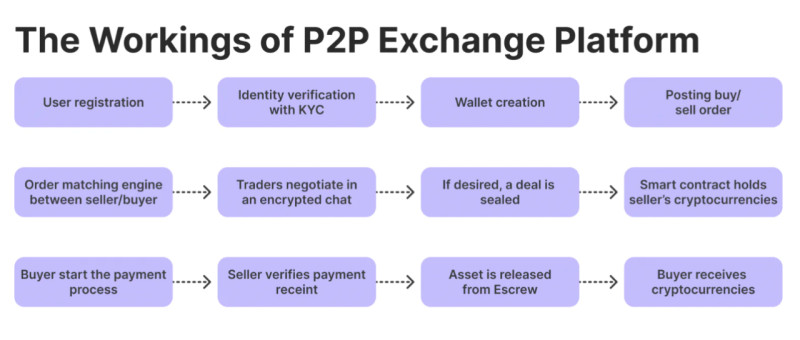

How transactions are carried out on P2P platforms

Let’s take a closer look at how transactions are conducted on P2P platforms. Cryptocurrency is transferred directly from the seller to the buyer without intermediaries. The seller posts an ad on the platform specifying the cryptocurrency they are selling, the price, and available payment methods.

The buyer searches for ads that match their needs. Once a suitable ad is found, the buyer places an order to complete the transaction with the selected seller. For user convenience, platforms often provide filters to simplify the search for offers.

How transactions happen: practical example

For example, User A posts an ad to sell 3 Bitcoins for US dollars at a specified rate. User B wants to buy 3 Bitcoins, finds User A’s ad, and places an offer to purchase.

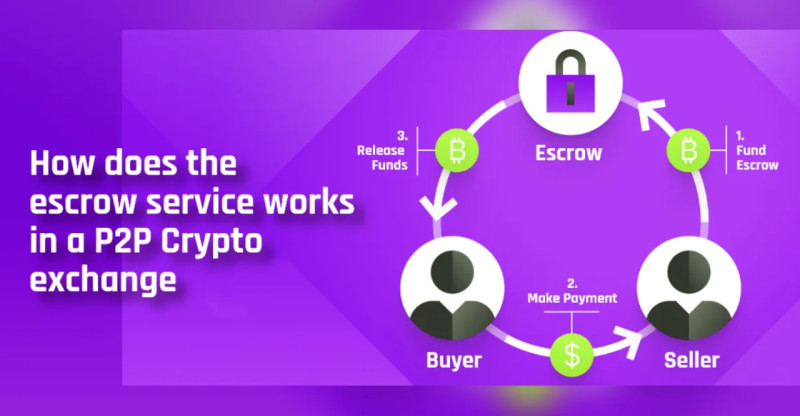

To ensure transaction security, many P2P platforms use escrow accounts to temporarily "freeze" assets during the transaction process. In this case, the Bitcoins will only be sent to the buyer’s wallet after the seller confirms payment.

All trading on these platforms relies on trust and reputation. Users who complete transactions successfully and on time receive higher ratings. This data is accessible to all platform participants, so it’s important to choose counterparts not only based on their terms but also their reputation.

Advantages of P2P platforms

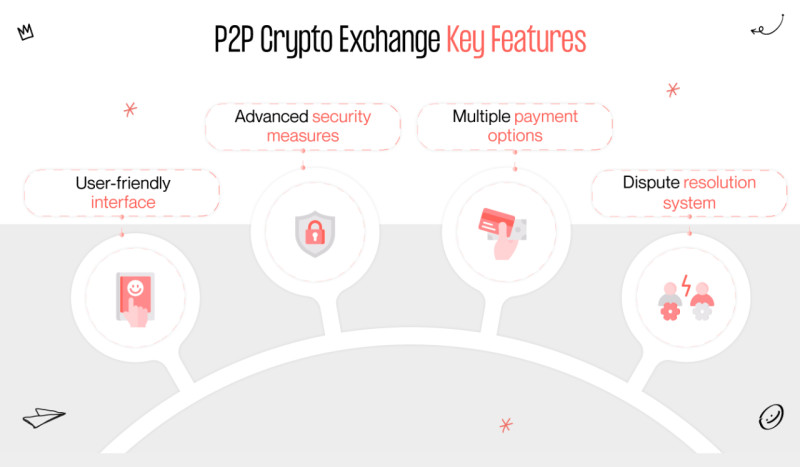

Any platform for trading digital currencies has its pros and cons, and P2P platforms are no exception. While P2P trading offers convenience, it also comes with potential risks. Here are the key advantages of these platforms:

- Convenience and accessibility: P2P platforms enable direct transactions between buyers and sellers without intermediaries like exchanges. Anyone from any country can register and use these platforms.

- No fees: Transactions occur within the blockchain network that hosts the platform, eliminating additional costs. As a result, users are not charged any transaction fees.

- Flexible exchange rates: Users can set their preferred buying or selling prices for assets. The key is finding a counterpart who agrees to the same terms.

- Security measures: Platforms ensure transaction security through user rating systems, escrow accounts, and other mechanisms.

- Variety of payment methods: Users can choose from over 100 payment options, including fiat currencies and digital payment systems like credit cards, debit cards, digital wallets, and bank transfers.

- 24/7 Operation: P2P platforms operate around the clock without holidays, making them especially convenient for users looking to profit from crypto trading.

Disadvantages and risks of P2P trading

Despite the many advantages of P2P platforms, there are risks and drawbacks to consider:

- Fraud: Even with security measures in place, users may encounter fraudulent counterparts. For instance, a scammer might demand urgent transactions without platform confirmation.

- Data breaches: P2P platforms store vast amounts of personal and financial data, making them attractive targets for cybercriminals seeking to exploit or blackmail users.

- Limited currency selection: These platforms typically support only the most popular digital currencies. Besides, there are fewer participants compared to cryptocurrency exchanges, leading to lower liquidity.

- Slow transactions: The speed of transactions depends on the blockchain’s capacity, which can vary. Transactions may take anywhere from minutes to days to complete.

- Irreversible transactions: Blockchain-based transactions are irreversible. If users make errors, such as entering incorrect data, the funds will be sent to another party, and the transaction cannot be undone.

- Legal uncertainty: Cryptocurrency trading is not legal in all countries, and constantly changing regulations can negatively impact P2P platforms. Moreover, users lack legal protection against fraud.

Summary

P2P platforms provide a unique and flexible way to trade cryptocurrencies directly. While they offer many benefits, such as lower fees, greater privacy, and transaction security, users must be cautious and consider potential risks like fraud or legal complications. For some, the benefits of personalized exchange rates and payment flexibility outweigh the drawbacks, making P2P platforms an increasingly popular choice in the crypto trading ecosystem.

P2P crypto: earning opportunities

Thanks to the flexible pricing of crypto assets on P2P platforms, cryptocurrency can be bought on one platform and sold on another at a higher price. This trading method, known as arbitrage, is widespread among P2P platform users.

The essence of arbitrage lies in trading the same currency on different platforms to profit from price differences. Cryptocurrency prices can vary significantly across platforms, primarily due to differing trading volumes.

It seems simple: buy crypto at a lower price and sell it at a higher one. However, this activity comes with challenges and risks, especially due to the high volatility of digital currencies. Prices can change rapidly, potentially dropping further after purchase, making profitable reselling impossible.

Even if reselling at a higher price is successful, fees may eat into profits. While most P2P platforms charge little to no transaction fees, hidden fees, such as account funding or withdrawal charges, may apply.

Technical issues, like transaction processing delays, can also affect profitability. For instance, delays might lead to unfavorable price changes, preventing users from achieving their desired profit.

To minimize risks and avoid losses in arbitrage, gaining knowledge and experience in the field is crucial. Additionally, traders should rely only on personal funds and avoid using loans or credit, as this can lead to debt in the event of losses.

Tips for safe P2P use

While P2P platforms offer direct transactions without intermediaries, certain precautions are necessary to avoid falling victim to fraud. Here are some essential safety tips:

- Choose a reliable platform

It is the first and fundamental rule. Since P2P platforms are decentralized, their security levels vary, and anyone, including scammers, can create an account. Opt for trusted platforms, compare ratings, and review user feedback. - Pay attention to transaction details

If anything seems suspicious, cancel the transaction immediately. For example, be cautious of offers involving third-party payments or transactions conducted outside the platform. - Verify your counterparty

Check the counterparty’s ratings and transaction history. Only transfer funds after confirming payment to your account.

4. Select reliable crypto wallets

Hardware wallets without internet access are considered the safest for storing crypto. However, for daily use, software wallets can be a more practical alternative.

5. Use additional security measures

Protect your account by enabling two-factor authentication, avoiding transactions outside the platform, and keeping software updated.

6. Open disputes when necessary

If you fall victim to fraud, open a dispute immediately. The platform’s team can investigate the issue and potentially halt the transaction.

7. Understand legal aspects

Cryptocurrency regulations vary by country. Be aware of the legal status of crypto in your region. Also, frequent transactions might attract attention from authorities due to anti-money laundering concerns.

Conclusion

This article examined various platforms for acquiring digital currencies, including exchanges, exchangers, and P2P networks. Among these, P2P platforms stand out for allowing direct transactions without intermediaries.

P2P platforms operate like bulletin boards, where users can post offers. When a match occurs, the transaction is completed. Sellers can set their prices, providing buyers with opportunities to purchase crypto at better rates than on exchanges.

While P2P platforms don’t set currency rates, they act as arbitrators in disputes. Escrow accounts further enhance security by holding funds until both parties fulfill their obligations.

Although P2P platforms ensure a higher level of safety, they still attract scammers and cybercriminals. Users must remain vigilant, carefully choose platforms and counterparts, and watch for suspicious behavior, such as third-party payments or transactions conducted outside the platform.

By following these tips, users can enjoy the benefits of P2P trading while minimizing risks and ensuring secure transactions.

Back to articles

Back to articles