Digital currencies, unlike any other asset, open up a wide range of income-generating opportunities. Moreover, their potential returns greatly exceed those of other instruments, making them highly attractive to users worldwide.

So, how can one earn with cryptocurrencies? You can start earning even without initial capital. If a user has limited time, passive income options are available. For more active users, there’s trading and arbitrage, which require constant participation in trading processes.

There are articles in our library devoted to the basics of cryptocurrency, the technology behind it, and the unique ways to earn with digital currencies.

Crypto income

Digital currencies are relatively new but quite popular assets. In many countries, they are still not recognized as legal tender, but transactions involving them are not prohibited. This means they can be used not for just payments but for generating income.

Since users have different starting resources, cryptocurrencies offer various earning options. Some methods require initial capital and/or in-depth knowledge, while others are suitable for beginners without experience or large sums.

The main ways to earn with digital currencies can be grouped into three categories:

- Cryptocurrency trading

- Coin mining

- Passive income generation

Key differences between these methods are shown in the table below.

| Parameter | Trading | Mining | Passive income |

| Profitability | Small per trade, depends on volume | Low solo, higher in pool | Depends on investment (percentage of sum) |

| Risk level | High | Moderate | Low |

| Starting capital | Can be small | Large | Moderate (depends on asset) |

| Time investment | High | High | Low |

We’ll briefly cover the most popular cryptocurrency trading methods in the next section, but first, let’s look at other options. Some digital coins require mining to introduce new units into circulation.

Mining involves using significant computational power to solve complex mathematical problems. Whoever solves the problem first gets the right to add a new block to the chain and receives a reward.

This earning method is now banned in some countries due to high energy consumption and environmental concerns. Mining equipment is also costly, making solo mining unprofitable. Therefore, miners join pools to work together or use cloud mining, renting equipment from third parties.

Brief look at crypto trading

When it comes to earning with crypto, trading is often the first thing that comes to mind. This is due to cryptocurrencies' high volatility, with constant price “jumps” up and down. However, earning from crypto trading includes several other income options:

- Trading means short-term speculative trades on the price movements of a cryptocurrency or currency pair. For traders, each price movement represents a profit opportunity, whether the price goes up or down.

- Holding is a long-term investment in crypto assets in anticipation of value growth over time. However, not all coins grow, so it’s essential to carefully choose assets to potentially increase, rather than diminish, wealth.

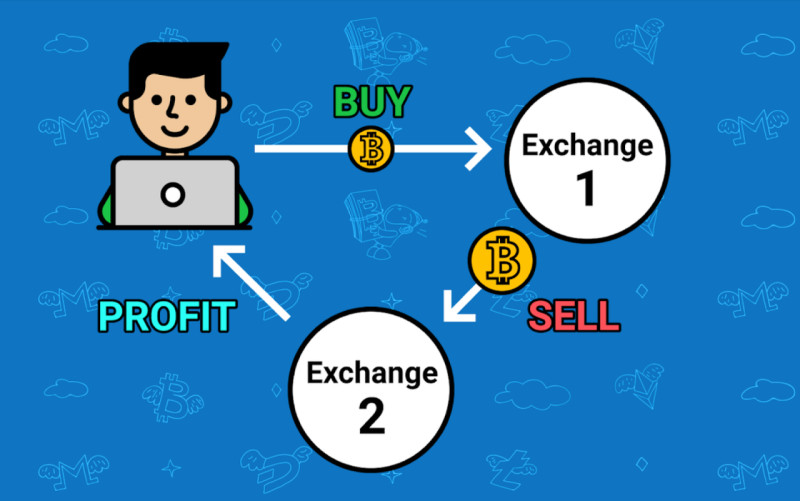

- Arbitrage implies earning from price differences of the same currency on different platforms. Well-known exchanges often have small price differences on popular currencies, but choosing less popular assets and smaller exchanges can yield significant profits.

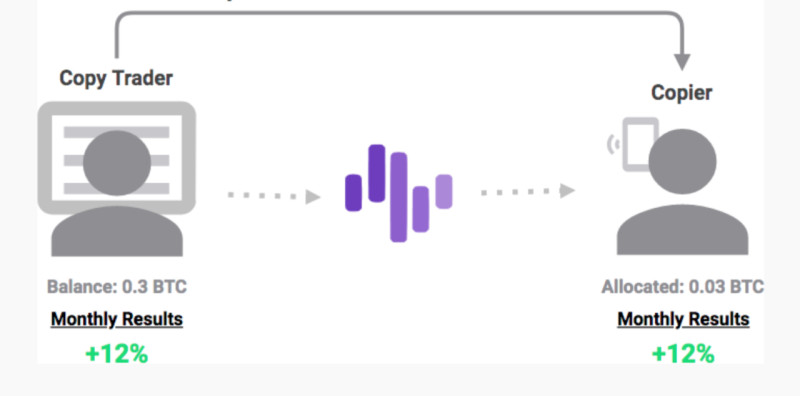

- Copy trading is replicating the trades of successful traders. This can be considered a passive income method since the user doesn’t need to take active steps. All that’s needed is a subscription to one or several successful traders to earn income.

- Participation in token sales – earning by buying coins of a new blockchain project before they are publicly available. Token sales come in various forms: ICO (initial coin offering, now outdated and replaced by others), IEO (initial exchange offering), and IDO (initial decentralized offering).

- NFT trading involves buying, creating, or upgrading unique digital tokens and then selling them. NFTs encompass music, artwork, and even entire collections where each item has its own value.

More on trading

With their high volatility, digital currencies are an ideal tool for earning on price fluctuations. This volatility means that earnings can be more frequent and substantial in the crypto market, as digital currencies can change by several percentage points within a single day.

The essence of trading boils down to opening positions on the rise or fall of a chosen crypto asset’s price. While this might sound simple, it requires thorough preparation, including market analysis and identifying the right moment to open a trade.

For analysis, traders often use technical or graphical methods, which allow them to make predictions based on the historical price movements of a particular coin. This involves learning to read and interpret charts effectively.

In addition, every trader should have their own strategy, including rules for entering and exiting trades. Having a strategy and sticking to it helps avoid mistakes driven by emotions or stress. It’s also crucial to regularly review past mistakes and learn from them.

Beginners may find it challenging to cover all these aspects, so trading cryptocurrencies is generally easier for experienced traders who have traded other assets. However, anyone can learn this with determination and patience. For new traders, it’s recommended to start with a demo account, where trading is done with virtual funds.

Another common option for beginners is copy trading, where they replicate the trades of experienced traders on their own accounts. To do this, they simply select one or more traders whose trades will be copied and then subscribe to them.

However, even copy trading has risks, as all trades—both successful and unsuccessful—will be copied. Therefore, careful selection of a lead trader is essential. Information about each trader, including ratings, reviews, and terms of cooperation, can be found on the copy trading service’s website.

Investing in cryptocurrencies

Investing is another popular method of earning through crypto. Income is generated by making long-term capital investments in selected crypto assets that show growth over time.

Digital currencies can indeed show impressive growth, often reaching tens, hundreds, or even thousands of percent, outperforming most other assets. However, it’s important to choose coins with strong growth potential—these could be well-established, reliable currencies or promising new projects.

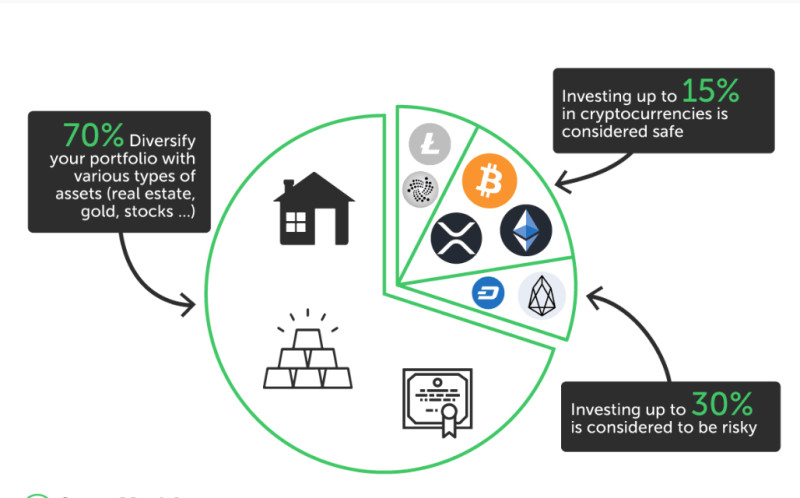

Like traders, investors also need an investment strategy. It’s advisable not to invest the entire sum at once but to gradually buy coins over time, increasing the holding. Another important rule is not to place all capital into a single asset.

Users should create an investment portfolio in line with their strategy. This portfolio should include crypto assets with varying levels of risk and potential returns. For more conservative investors, most of the portfolio should consist of well-known, liquid coins or even a combination of cryptocurrencies with other assets, like stocks, for instance. For more aggressive investment strategies, assets with higher risk levels—such as new, growing projects—can be chosen.

However, it’s essential to understand that these projects might either deliver significant growth or disappear altogether. Therefore, it’s crucial to evaluate each crypto project by its core concept, development team, community, and other factors.

The advantage of investing is that users don’t need to monitor price changes constantly, as with trading. For holding, only the long-term growth prospects of the cryptocurrency matter, not short-term fluctuations.

Participating in token sales

As discussed, token sales can be conducted in several ways: ICO, IEO, and IDO. These differences influence the profitability that crypto can provide, with earnings largely dependent on the stage at which the user enters the project.

Project launch is often considered the most favorable time for capital investment, as it allows the purchase of crypto assets at a lower price before their open market launch. The stock market equivalent of token sales is an IPO—initial public offering—after which shares begin trading on an exchange.

Token sales are generally conducted in three stages, each with its own objectives and conditions:

- Private sale. Only large investors are allowed to participate, making this the most advantageous purchase time, though it also carries the highest risk. Such deals typically come with specific conditions, such as restrictions on coin sales for a certain period.

- Presale. A broader group of users on the whitelist is granted access to purchase the currency. At this stage, the project has not yet launched, but there is a working version. Presales are used to attract public attention, and the entire token issuance may be distributed at this stage.

- Public sale. At this point, anyone can purchase coins at a fixed price. By this time, the product is typically launched, and the listing date on crypto exchanges is often announced.

Let’s look at the mechanisms used for conducting a token sale:

- ICO is the most common format, though becoming less popular. Startups issue and sell coins that can later be used within the project to pay for services.

- IEO is deciphered as an Initial Exchange Offering, held by established crypto exchanges. They handle project selection and are responsible for the token launch. Developers do not influence the process, and listing occurs immediately after the sale.

- IDO stands for Initial Decentralized Offering, conducted on decentralized exchanges. The developers handle all aspects, such as emission, coin pricing, and unlocking schedules, rather than the exchange management.

Ways to earn passive income

As previously mentioned, holding involves a long-term investment in anticipation of price growth. This can yield several hundred or even thousands of percent in returns, though funds remain “frozen” until a profit is realized after several years.

Other ways to earn without constant effort and frequent actions, as in trading, exist. These are passive income options for digital currencies. Let’s explore two main options: staking and lending.

Staking involves buying and holding a specific cryptocurrency, which the platform then uses to support its operations. It’s similar to a bank deposit: you put money into an account and earn interest.

The currency holder also acts as a validator in such chains, gaining the ability to create a node, verify transactions, and add new blocks to the chain. Tokens used for staking guarantee the validator's honest performance. If they add false data to the blockchain, they lose their staked coins. When performing duties correctly, the validator earns a reward as a percentage of the staked amount.

Lending works similarly to a bank loan. The user buys cryptocurrency and lends it to the exchange, which uses it for its purposes, such as lending to other users, and pays the lender a reward as a percentage of the amount provided.

In addition to exchanges, there are dedicated platforms where users can directly lend cryptocurrencies to others. However, working with exchanges is generally simpler and safer, as they offer more digital currencies and often higher interest rates.

Ways to earn without investment

Let’s talk about cases where users don’t have initial capital but understand the appeal of crypto. There are ways to earn in such cases that require minimal time and effort. Let’s look at these options in detail.

The first and most well-known method is participating in airdrops. These are marketing campaigns where a new blockchain project distributes its currency for free in exchange for users meeting specific conditions.

Typically, these conditions are simple: subscribing to the project's social media accounts, reposting content, and so on. Different actions have different values; for instance, reposting is more valuable than subscribing. Additionally, the larger the follower count of the user performing the repost or subscription, the higher the potential reward.

Airdrops aim to popularize the crypto project and its currency and attract new investors. You can find projects conducting such coin giveaways using special services, though care should be taken to avoid scams. It’s also important to note that airdrops aren’t very frequent.

Profitability from these events mainly depends not on the currency distribution itself but on its future development. If the project fails to gain traction and the currency never appears on any crypto exchange, then the time spent is ultimately wasted.

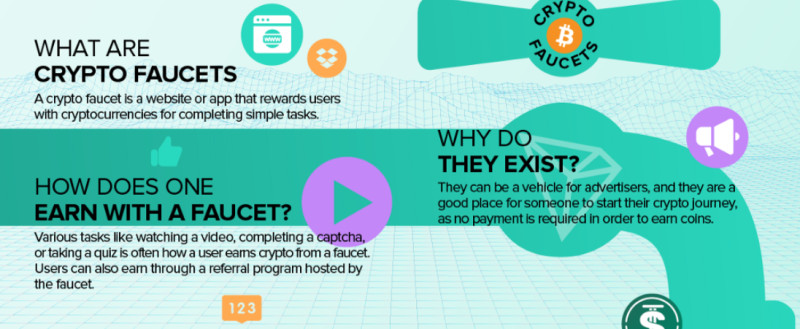

Another way to earn is through faucets, which are special websites that reward coins for completing simple tasks, such as solving captchas. This work is very simple, but the pay is minimal—only a few satoshis (0.00000001 Bitcoin).

Earning a substantial amount on such platforms is unlikely, but these services also conduct prize draws among participants. While the reward for routine actions is tiny, the prize for a draw winner can be worth hundreds of dollars.

Another method of earning is through affiliate programs. Each participant receives a unique referral link. When other users click on this link and register on the site, the link owner receives a reward.

How much can you earn from crypto?

We’ve established that there is a vast array of ways to make money with digital currencies. However, the potential earnings can vary significantly depending on the chosen method. Let’s explore what kind of earnings you might expect from different options.

With "free" income methods that don’t require initial capital investment, you won’t make substantial earnings. For instance, faucet websites pay mere cents, so no matter how many tasks a user completes, it’s unlikely they’ll even reach $500.

For airdrops, it largely depends on the value of the currency once it’s listed on an exchange. If the project really “takes off,” tokens can be sold at a profitable price. However, much also depends on the number of coins received during the airdrop.

Options like trading and arbitrage can generate around $1,000 per month, with some traders earning up to $5,000 monthly, depending on how much time they devote to it. If you trade continuously and make numerous transactions daily, such income is achievable.

However, it’s important to remember that the profits from frequent trades will partly be “eaten” by fees on each transaction. Thus, finding a balance between the quantity and quality of positions is essential.

For investments, returns largely depend on the initial capital. The more a user can invest, the higher the potential earnings, though the risks are also significant. Cryptocurrencies can surge thousands of percent in a year or plummet by hundreds of percent.

Since Bitcoin’s launch, its value has zoomed up by 9,000 times. Many other crypto projects have shown significant growth, so a well-constructed investment portfolio could yield 300% to 500% annually.

For passive income methods, much depends on the platform conditions for lending or staking. On average, lending can bring up to 15%, while staking yields can reach 40% depending on the specific currency.

Conclusion

In this article, we explored how much income crypto can bring. Earnings vary greatly based on the chosen method and strategy. Digital currencies are an ideal trading asset since their price fluctuations can reach hundreds or even thousands of percent.

Each user can choose an income option that best fits their personality, free time, and available funds. With crypto, it’s possible to start earning without any investment by using airdrops, faucet websites, and other resources.

Active and experienced users may opt for trading or arbitrage, earning from price changes of specific currencies. For them, every price movement matters, as it allows them to open positions for growth or decline. While each trade may yield small profits, volume can add up to a respectable monthly income.

For users who prefer a more hands-off approach or cannot monitor price charts constantly, calmer earning methods like investing, staking, and lending are suitable. Investors put in capital long-term, hoping for value appreciation.

Staking and lending resemble bank deposits and lending, respectively. In staking, a certain amount of a project’s currency is locked in an account to support its operation, while in lending, coins are loaned out to other users or the exchange itself.

Back to articles

Back to articles