Every investor wants to maximize potential returns on their investment. Cryptocurrencies are uniquely suited for this purpose as their value can increase by tens, hundreds, or even thousands of percent.

However, to achieve these hundreds and thousands of percent in profits, one needs to correctly choose the digital currencies for investment. In this article, we will discuss the criteria to consider when selecting coins for investment and which specific coins have the best growth prospects.

To learn more about what cryptocurrencies are, their different types, how new digital currencies appear, and the main benefits and risks of investing in new coins, you can read the article "New Cryptocurrencies".

How to assess cryptocurrency potential

When it comes to acquiring digital currencies for investment, it is crucial to carefully select crypto assets. There are several factors to consider when determining which cryptocurrency is the most promising:

- Project website: The first step is to visit the currency's website. It should be user-friendly and error-free. The website should provide information about the development team, key partners and investors, the project's goals, and the currency's white paper.

- White paper: This is the main document outlining the goals and strategies for using a digital currency. It includes information on the coin's tokenomics such as emission and distribution of coins as well as the token burn policy. There should also be a roadmap detailing the development plan for several years ahead.

- Project’s social media: Most major projects have accounts on multiple social networks, the main ones being Twitter (now X), Reddit, and Discord. You can analyze the number of followers and activity in the comments, as well as overall mentions of the currency by tags.

- Development team and partnerships: This information can usually be found on the website or social media. It is a good sign if the development team includes well-known figures in the cryptocurrency space who have previously participated in launching other successful projects.

- Market metrics: For various financial indicators such as market capitalization, trading volumes, price changes, and others, you can visit specialized websites that rank digital currencies.

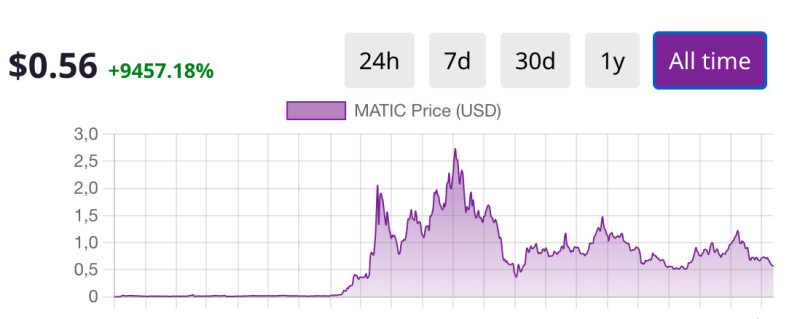

- Price volatility analysis: Cryptocurrencies are highly volatile assets, meaning their prices can fluctuate significantly even in the short term. Ideally, you should look for currencies whose value is gradually increasing, although this can be challenging.

- Cryptocurrency functionality: Not all digital currencies serve a useful function. Coins that solve specific problems or enhance blockchain functionality are preferable. However, some meme coins that don’t provide any utility also gain popularity.

Website, social media, and white paper analysis

The first step in choosing the most promising cryptocurrency is to evaluate and understand the project itself. Carefully study its website, white paper, and social media accounts.

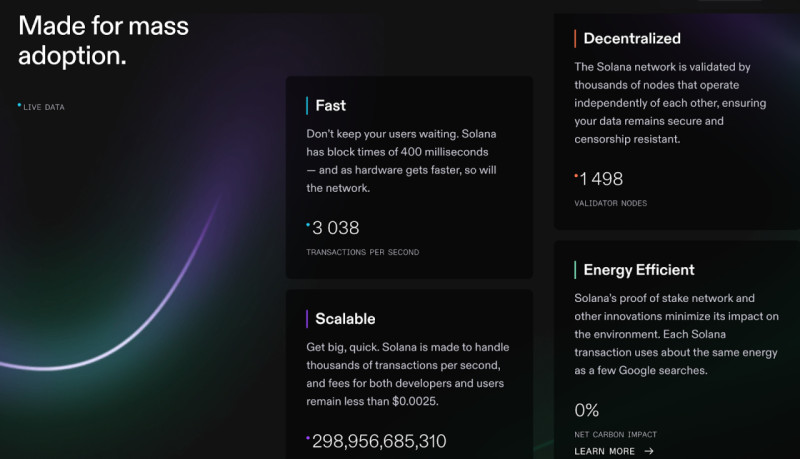

It is important to understand the project's goals and whether it has any unique technology that could provide a competitive advantage. For example, it may be a unique consensus algorithm that could increase chain scalability, i.e., transaction processing speed, or reduce commission fees.

Information about the project's goals and strategies for using the cryptocurrency can be found in the white paper. Equally important is tokenomics, which describes how coins will be distributed among investors, and the mechanisms for issuing and burning coins to maintain the balance of supply and demand.

Another crucial aspect of any white paper is the roadmap, which outlines detailed plans for the project's future development, typically spanning several years. If the white paper is missing or contains errors, such as grammatical or spelling mistakes, this is a warning sign.

On social media, you can find information about new project launches and other related news. In addition to the official cryptocurrency social media channels, where you can study the project team's interaction with users, you can also search for user mentions and discussions to analyze whether the feedback is mostly positive or negative.

Nevertheless, it is not worth relying solely on information from the project's website or social media. Creating a website or a social media account is very easy and costs virtually nothing, so scammers can use these resources to obtain funds from unsuspecting users.

Analysis of market indicators

When evaluating any cryptocurrency project, it is essential to pay attention to its financial indicators. They will help you better understand which cryptocurrency is the most promising. Let’s consider the most important indicators to watch.

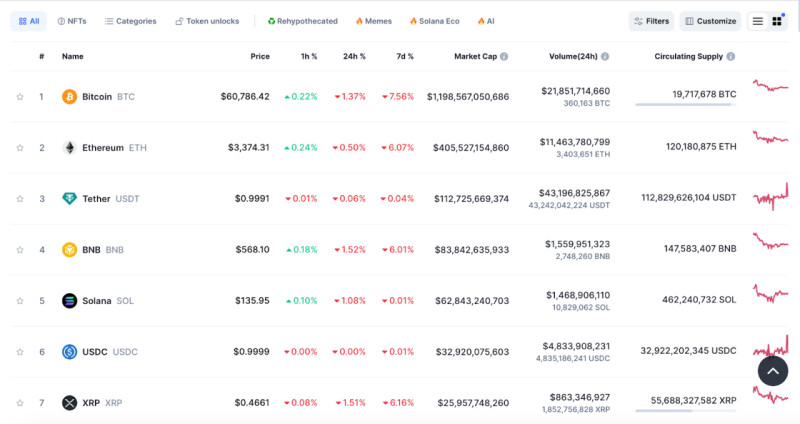

Market capitalization is the first and most crucial parameter. You can find this data on special aggregators such as CoinMarketCap, CoinDesk, CryptoRank, CoinGecko, and others. These websites compile their own rankings of digital currencies.

These rankings are dynamic, meaning that the data changes daily. As a currency gains or loses value, its position changes. On these websites, you can find information about any existing cryptocurrency, including market capitalization, current exchange rate, trading volumes, and other metrics.

Market capitalization is calculated by multiplying the value of the cryptocurrency by the total number of coins in circulation. Many new digital currencies start with a relatively low value, so significant issuance is needed to achieve good market cap numbers.

Investments in cryptocurrencies within the top 100 of the digital currency rankings are considered the safest. However, not all new and promising projects make it into this group. Therefore, many experts recommend waiting for the project to gain traction rather than entering the market at the presale stage of coins.

Trading volume is another important indicator, which shows how many units of a particular currency have been sold over a certain period of time. High volumes indicate investor interest in the currency, which in turn increases its liquidity and price stability.

In addition to the total number of coins in circulation, there is another metric – the total maximum supply of the currency. This indicator points to potentially rare coins that could affect the currency's value in the future, either upward or downward.

Cryptocurrency functionality

An important factor that can significantly influence the future of a particular digital currency is the usefulness of the project behind it. Therefore, when searching for the most promising cryptocurrency, it is necessary to examine its functionality.

It is crucial to understand that not all cryptocurrency projects have practical applications. There is a whole category of coins called meme tokens, which do not offer any utility to users and serve only as entertainment.

Nevertheless, such projects have a right to exist, and many of them occupy top positions in cryptocurrency rankings. However, useful functions that currencies can perform certainly add points in the eyes of investors.

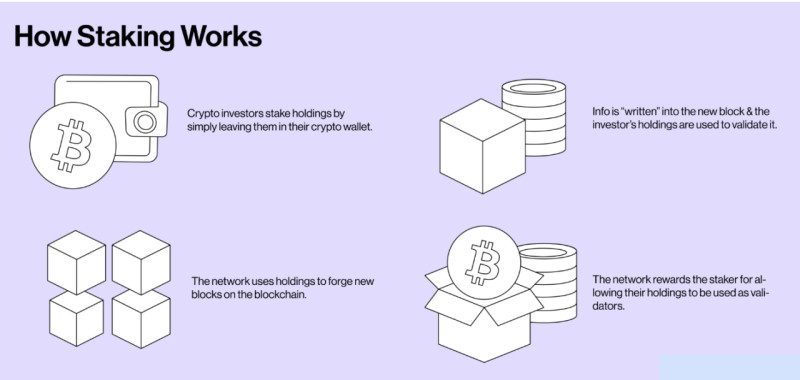

The first and most well-known digital currency, Bitcoin, already serves as a means of payment, which is its primary purpose. However, cryptocurrencies can also perform other functions such as maintaining blockchain operations through staking.

Staking involves locking a certain number of coins for a set period by validators, who then earn the right to verify transactions on the blockchain and add new blocks to the chain. These coins serve as a guarantee of the quality performance of the validators, who are rewarded for their work.

Utility tokens are another notable category of digital currencies. They not only perform basic functions such as paying transaction fees but also grant their holders the right to participate in project governance by voting and proposing their initiatives.

Other factors to consider

In addition to internal factors directly related to each digital currency, such as its key features, technologies, and development team, there are external factors that must be considered when determining which cryptocurrency is the most promising.

The legal status of digital currencies is one of the first factors to consider. The fact is that in many countries, cryptocurrency is still not recognized as legal tender, meaning it cannot be used for transactions. In some countries, any operations with coins, including mining, purchasing, or transferring them to others, are prohibited.

Such regulatory measures at the government level can have a negative impact on the entire cryptocurrency sector and lead to a decrease in the value of coins. Conversely, the establishment of favorable conditions can lead to price increases and higher demand for crypto.

The second factor is financial, political, and economic events. Despite blockchain's foundation in decentralization and independence from any state or government entity, digital currencies cannot exist in isolation from the world around them.

During periods of instability in traditional financial markets, conflicts, or other significant disruptions, investors’ risk tolerance often decreases, and they flee to more reliable and stable assets. In calmer times, they feel more confident and invest in riskier assets like cryptocurrencies.

The third factor is technological innovation. Blockchain technology itself was a breakthrough and can be used for data transfer and storage not only in the cryptocurrency sphere but also in many other areas. However, it continues to evolve, and projects that apply technological innovation have a better chance of success.

Which cryptocurrency to choose for short-term investment

The digital currency market has a characteristic where it often shows either simultaneous growth or decline across almost all assets. In other words, when the market is rising, the prices of all major currencies tend to increase, and when the market is falling, the prices tend to decrease.

Therefore, when determining which cryptocurrency is the most promising, you need to assess the overall state of the market. Currently, the value of most digital currencies is far from its peak, but experts predict significant price growth.

In addition, it is important to pay attention to industry news, the introduction of new technologies, or investments by major companies. Fresh coins that are just entering the market are also good for quick profits. They can show growth of several hundred percent in the first few days of trading.

However, it is crucial to remember the higher level of risk compared to investing in already well-known coins. Such startups can turn out to be scams or "bubbles" that burst immediately after being listed on an exchange.

Therefore, if investors are not willing to take high risk, they should choose assets that have been in the market for several years but still have potential for further upside. Here are some examples of such cryptocurrencies that are currently considered promising:

- Solana: The Solana platform and its native token SOL were created to increase blockchain scalability. Thanks to its unique consensus algorithm, this network shows excellent performance – its throughput is 65,000 transactions per second.

- Tron (TRX) is a platform designed to build decentralized applications in various fields, including social networking, education, and entertainment. The project has received strong support from the cryptocurrency community.

- Aave is a service that allows users to earn interest on their money or borrow money without intermediaries like banks. AAVE tokens serve several functions within this service, including project governance.

- Chainlink (LINK) is a platform known for its ability to integrate and interact with external data sources, including a strategic partnership with the Swift banking system. In 2023, the project's token, LINK, outpaced Bitcoin in growth rate.

Which cryptocurrency to choose for long-term investment

In the classic sense, investing means putting money into assets for an extended period of time, often several years. During this period, the money is "frozen" and cannot be used for other purposes, so the most reliable and stable assets are chosen for such purposes.

Determining which cryptocurrency is the most promising for long-term investment is not easy due to the vast variety of cryptocurrency projects. For long-term investors, daily fluctuations in currency value are not significant; they care about its potential for long-term growth.

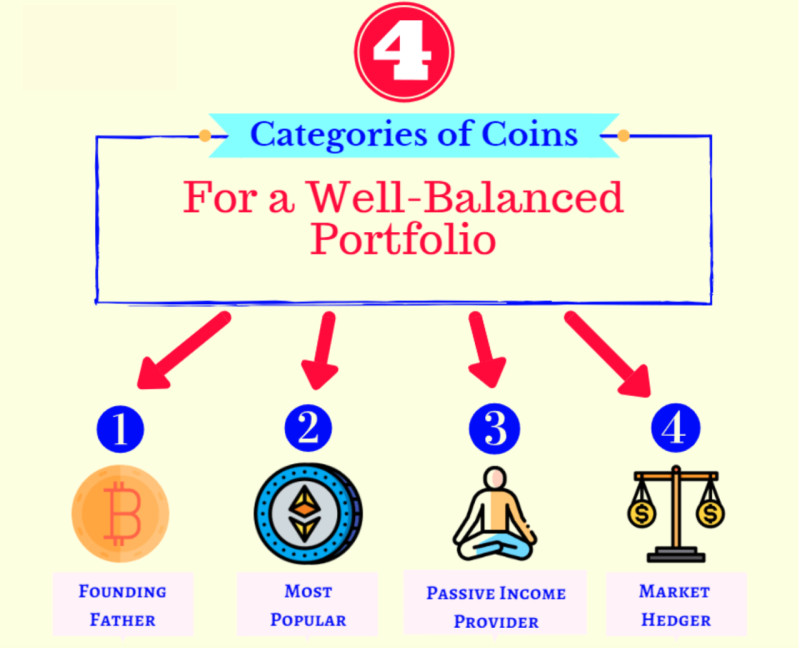

The first and most important rule for an investor is not to "put all eggs in one basket," meaning not to invest all capital in one currency, no matter how attractive it may seem. It is necessary to create an investment portfolio that includes assets with different levels of risk and potential returns.

Some investors prefer to create more conservative portfolios, where digital currencies do not exceed 5-10% of the total investment. Others create more aggressive portfolios that may consist entirely of different cryptocurrencies.

In any case, correctly selecting specific currencies for investment becomes a key factor for success. More reliable cryptocurrencies include well-known coins that have been in the market for many years and show stable gains such as Bitcoin, Ethereum, Litecoin, and others.

These coins continue to rise in value and remain excellent investment vehicles. However, their prices are quite high, especially for Bitcoin, making them less accessible to a wide range of investors, although these coins can be purchased in parts.

As for new projects, it is necessary to consider all the above factors before investing in them. This is because not all new cryptocurrencies manage to shoot up and gain tens or hundreds of percent, but when it happens, investors make hefty profits.

Most promising cryptocurrency

We have already discussed many factors to consider when looking for the most promising currencies for investment. Let's summarize this information and determine the criteria that a digital currency should meet to have good upside potential.

The first is the openness and accessibility of information about the project itself, its developers, key partners, and investors. This information should be available on the project's official website and social media accounts. High demand from investors speaks in favor of a cryptocurrency.

Next is the presence of unique technology or other innovative features that can significantly improve blockchain functionality, such as increasing its throughput or providing new revenue or passive income opportunities.

Another important factor is the absence of overbought conditions, which indicate a rapid increase in the value of a cryptocurrency, causing it to trade at a higher price than its real value. This can be attributed to various factors such as market speculation.

It is also important to understand that an overbought period is followed by a correction, where the value decreases to reach the fair price level. There are also periods of oversold conditions where coins trade below their true value, making it a good time to buy.

The investment period is crucial when choosing crypto assets. For a comparison of selecting currencies for short-term and long-term investment, see the table below:

| Criterion | Short-term investment | Long-term investment |

| Investment period | From a few days to a few weeks | From a few months to several years |

| Analysis | Mainly technical | Mainly fundamental |

| Opportunities for passive income | No | Yes |

| Earning opportunities | One can earn from both price increases and decreases | Earnings from gradual price growth |

| Risk | High | Medium |

Conclusion

In this article, we discussed the criteria to consider when determining the most promising cryptocurrency. The main factors include market indicators, the development team, technological innovations, cryptocurrency functionality, and others.

Both new projects emerging in the market and well-known cryptocurrencies can offer potentially high returns. The difference lies in the initial investment amount: the cost of new coins entering the market is often significantly lower than that of established and popular currencies.

However, price is not the only factor to consider. Equally important indicators are market capitalization and trading volume, which indicate investor interest in a particular currency. Another positive factor is the absence of overbought conditions, meaning inflated prices.

The presence of innovative technology or other unique features that distinguish the project from other similar ones is another positive aspect. This could be a solution to increasing chain scalability, reducing costs, generating passive income, etc.

If a digital currency has useful functions, it makes it more appealing to investors. Coins can be used not only as a means of payment or an investment vehicle but also for passive income, performing management functions, and more.

Back to articles

Back to articles