signal strength 1 of 5

According to the chart of M5, USDCHF formed the Bullish Symmetrical Triangle pattern. The lower border of the pattern touches the coordinates 0.8825/0.8830 whereas the upper border goes across 0.8835/0.8830. If the Bullish Symmetrical Triangle pattern is in progress, this evidently signals a further upward trend. In other words, in case the scenario comes true, the price of USDCHF will breach the upper border to head for 0.8845.

The M5 and M15 time frames may have more false entry points.

See Also

- All

- Double Top

- Flag

- Head and Shoulders

- Pennant

- Rectangle

- Triangle

- Triple top

- All

- #AAPL

- #AMZN

- #Bitcoin

- #EBAY

- #FB

- #GOOG

- #INTC

- #KO

- #MA

- #MCD

- #MSFT

- #NTDOY

- #PEP

- #TSLA

- #TWTR

- AUDCAD

- AUDCHF

- AUDJPY

- AUDUSD

- EURCAD

- EURCHF

- EURGBP

- EURJPY

- EURNZD

- EURRUB

- EURUSD

- GBPAUD

- GBPCHF

- GBPJPY

- GBPUSD

- GOLD

- NZDCAD

- NZDCHF

- NZDJPY

- NZDUSD

- SILVER

- USDCAD

- USDCHF

- USDJPY

- USDRUB

- All

- M5

- M15

- M30

- H1

- D1

- All

- Buy

- Sale

- All

- 1

- 2

- 3

- 4

- 5

According to M30, AUDCHF is shaping the technical pattern – the Inverse Head and Shoulder. In case the Neckline 0.5563/0.5560 is broken out, the instrument is likely to move toward

Open chart in a new windowAccording to the chart of M15, NZDJPY produced the pattern termed the Inverse Head and Shoulder. The Head is fixed at 85.95 while the median line of the Neck

The M5 and M15 time frames may have more false entry points.

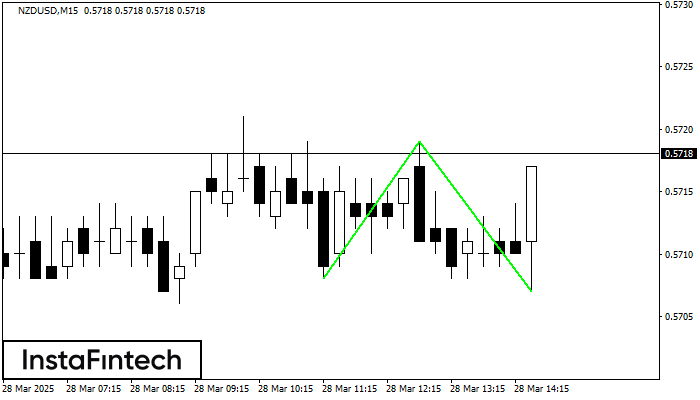

Open chart in a new windowThe Double Bottom pattern has been formed on NZDUSD M15. Characteristics: the support level 0.5708; the resistance level 0.5719; the width of the pattern 11 points. If the resistance level

The M5 and M15 time frames may have more false entry points.

Open chart in a new window